Top Payment Processing Tools for E-commerce Success in 2025

Discover the best payment processing solutions for your online store. Compare features, pricing, and integration options of leading platforms like Stripe, Square, and PayPal.

In today's digital marketplace, choosing the right payment processing solution can make or break your e-commerce success. Whether you're launching a new online store or optimizing an existing one, understanding the latest payment processing tools is crucial for maximizing conversions and revenue.

Understanding Payment Processing Essentials

Payment processing is the backbone of any e-commerce operation, facilitating secure transactions between your customers and your business. Let's explore the key components and top solutions available in 2024.

Core Features to Consider

- Security Compliance: PCI DSS certification and fraud prevention

- Payment Methods: Credit cards, digital wallets, and alternative payments

- Integration Capabilities: API flexibility and platform compatibility

- Fee Structure: Transaction costs and monthly fees

- Global Support: Multi-currency and international payment options

💡 Pro Tip: Always prioritize payment processors that offer robust fraud protection and chargeback management to protect your business.

Top Payment Processing Platforms

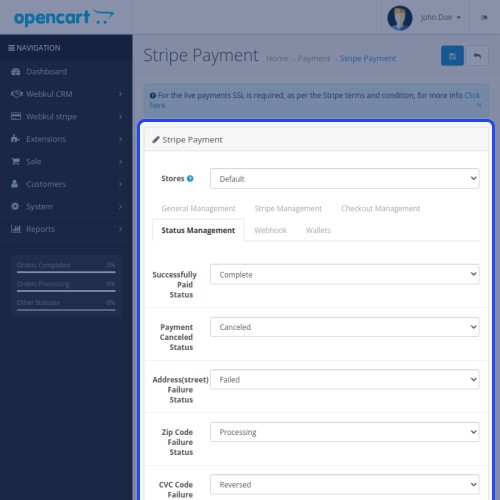

Stripe

Stripe leads the market with its developer-friendly approach and comprehensive feature set.

- Key Features:

- Customizable checkout experience

- Advanced fraud detection

- Subscription billing support

- Real-time reporting dashboard

Pricing: 2.9% + $0.30 per successful card charge

PayPal

PayPal remains a trusted choice with its widespread consumer adoption and easy setup.

- Benefits:

- Instant brand recognition

- Built-in buyer protection

- Express checkout options

- Mobile optimization

Integration Guide

Step-by-Step Implementation

- Choose Your Platform:

- Evaluate business needs

- Compare pricing structures

- Check platform compatibility

- Setup Process:

- Create merchant account

- Complete verification steps

- Configure API credentials

- Testing Phase:

- Run test transactions

- Verify webhook responses

- Monitor error handling

- Launch Preparation:

- Document procedures

- Train support staff

- Plan rollout strategy

Security Best Practices

- Implement SSL certificates

- Regular security audits

- Monitor suspicious activities

- Keep software updated

Advanced Features

Analytics and Reporting

- Transaction Insights:

- Sales trends

- Customer behavior

- Conversion rates

- Chargeback analysis

Mobile Solutions

- Key Considerations:

- App integration

- Mobile checkout optimization

- Contact-less payments

- Digital wallet support

Common Integration Challenges

Technical Issues

- API documentation gaps

- Testing environment limitations

- Webhook configuration

- Error handling scenarios

Business Considerations

- Transaction fee impact

- International payment complexities

- Compliance requirements

- Customer support needs

Tools and Resources

Development Tools

- Testing:

Postman,Stripe CLI - Documentation: API guides, SDKs

- Support: Developer forums, knowledge bases

Monitoring Solutions

- Transaction Monitoring:

- Real-time alerts

- Error tracking

- Performance metrics

- Security monitoring

Future Trends

Emerging Technologies

- Cryptocurrency payments

- Biometric authentication

- AI-powered fraud detection

- Open banking integration

Conclusion

Selecting and implementing the right payment processing solution is crucial for e-commerce success. Focus on security, user experience, and scalability when making your choice. Regular monitoring and optimization will ensure your payment system continues to meet your business needs.

Ready to optimize your payment processing? Explore our recommended solutions and boost your conversion rates today!

🚀 Quick Tip: Start with a payment processor that offers a free trial or sandbox environment to test functionality before committing.